Budgeting: The Hilarious Art of Telling Your Money Where to Go

Ah, budgeting. That magical activity where you try to take your paycheck and stretch it like it's made of rubber—only to realize it behaves more like a soggy noodle.

The word alone can send shivers down your spine, much like hearing "We need to talk" from your boss..or when my mother would say “Mohaaaan” in a high shriek!! But fear not! With a dash of humor and a sprinkle of wit, managing your finances can be as entertaining as binge-watching your favorite sitcom.

So, grab your calculator, and let's embark on this comical journey to financial enlightenment.

Step 1: Accept That You Need a Budget (Denial Is Not a Financial Plan)

First, let’s be honest: If you don’t have a budget, your bank account is probably doing a disappearing act worthy of a Las Vegas magician. The first step in budgeting is acknowledging that your money needs a map. Otherwise, it just goes rogue like a teenager with a new driver’s license.

Step 2: Track Your Expenses (A.K.A. Confront Your Financial Reality)

Before you create a budget, you need to figure out where your money is actually going. And no, "general life expenses" is not a valid category.

Track your spending for a month, and you may find that:

You're spending more on coffee than groceries.

That “small” subscription list is eating half your paycheck.

You have a mysterious category labeled "Miscellaneous" that accounts for 40% of your expenses.

Use apps like:

Mint – Like a financial life coach, but free.

YNAB (You Need A Budget) – Perfect if you like aggressive organization.

PocketGuard – Tells you if you can afford that impulse buy. Spoiler: You probably can’t.

If you prefer old-school methods, you can also use a simple notebook, but let’s be real: You’ll probably forget to write things down after a week.

Step 3: Categorize Like a Pro (Yes, You Need More Than Just ‘Bills’ and ‘Stuff’)

A good budget has clear categories. Break your expenses into:

Essentials: Rent, groceries, utilities, coffee (yes, I said it).

Savings & Investments: Future-you will thank you.

Fun Money: Because life isn’t just about paying bills.

Emergency Fund: Because life is about unexpected car repairs and surprise medical bills.

If your budget is 90% "fun money," you’re doing it wrong (but hey, at least you’re honest).

Step 4: Set Spending Limits (A.K.A. The Hard Part)

Now that you know where your money should go, assign realistic spending limits. If you set your food budget at $20 per month, you’ll be living off ramen noodles by week two.

Pro tip: Leave some wiggle room. No one sticks perfectly to their budget—life happens. Just don’t let that be your excuse for buying everything on sale.

Step 5: Automate, Automate, Automate

Do you forget to pay bills? Does payday make you feel rich for 48 hours before reality sets in? Then automation is your best friend.

Set up:

Automatic bill payments – Because late fees are just donations to your bank.

Automatic savings transfers – So you don’t "accidentally" spend everything.

Step 6: Check Your Budget Regularly (Because It’s Not ‘Set and Forget’)

A budget is like a relationship—it needs attention to work. Review your budget at least once a month:

Are you overspending in one category?

Did you forget to account for something?

Is your bank account crying for help?

If your budget is off-track, adjust it. It's not written in stone—unless you’re using ancient accounting methods, in which case, wow!

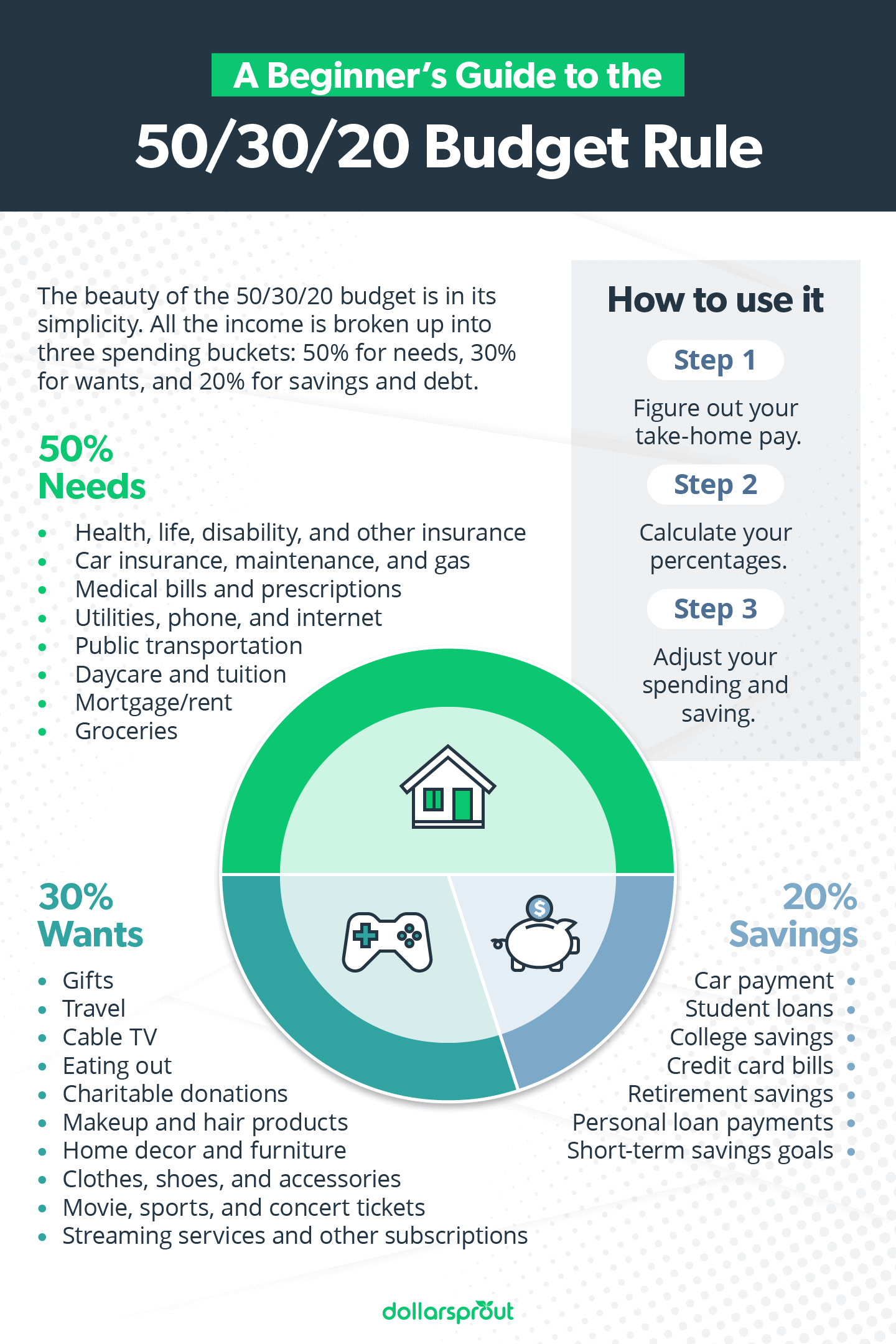

The most important budgeting rule

Now that we know the why of budgeting, I want to introduce you to the most important rule of budgeting.

By now you know,

Pay yourself first…20%

then the needs …say 50%

And only if you have anything left should we go to wants…

Most people do it otherwise and wonder why they are always chasing money!!

Final Thoughts: Budgeting is Like a Video Game—Except You Actually Win in Real Life

Budgeting doesn't have to be a dreary task. By injecting humor into your financial habits, you can transform budgeting from a chore into an enjoyable challenge. Remember, it's not about restricting yourself but making mindful choices. So, the next time you're about to make an impulsive purchase, pause and ask yourself: "Is this worth a week of instant noodles?" (I do love my Maggie noodles)

Embrace the journey with a smile, and watch as your savings grow and your financial stress diminishes. After all, laughter might not pay the bills, but it certainly makes managing them a lot more fun.

We are done with the foundations of wealth and next week we will get into the foundations of time. Managing time and how i go about it!! Again no gyan, just my experiences…

Till then stay curious…

What a lovely way of making us take budgeting seriously.. loved it .

Keep them coming