Savings : The heart of a Balanced Life

This is a gift that keeps giving...Savings is NOT a sacrifice; it is an investment in your future happiness and freedom.

Today, I’m diving into what might just be the most yawn-inducing yet life-changing part of a balanced financial life – Savings! Yes, I said it. Savings, that invisible superhero in your financial lineup, working behind the scenes like a ninja to protect you from life’s unexpected “uh-oh” moments. And trust me, if I can stick to saving despite my inner shopaholic screaming, you absolutely can too.

Why Savings Matter (Even if They’re Not as Glamorous as a New Gadget)

Imagine waking up each morning knowing you have a financial cushion that’s as comfy as your favorite pair of sweatpants. No, I’m not talking about that magical “money tree” in your backyard (though a money tree would be pretty awesome). I’m talking about the simple, powerful act of saving. Whether it’s for an impromptu dance party in your living room (because, why not?) or a well-deserved vacation when life throws lemons at you, savings give you the freedom to choose from a place of stability rather than sheer panic.

Now, let’s get real for a minute. You must think I come from lot of money to even talk about savings…Nah!!

I come from a very low middle class family—where saving was practically a sport. We saved in every creative way possible: from using pliers to squeeze every last drop of toothpaste (yes, even that stubborn bit at the end) to resoling shoes that lasted longer than some of my relationships, and yes, even rocking those hand-me-down dresses like a fashion statement. I’ve done it all!

Fast forward to my MBA days at the University of Michigan, Ann Arbor, in 2001. Picture this: a mountain of debt so high you’d need a sherpa to climb it. But guess what? I not only paid it off (faster than a cheetah on roller skates) but also bid farewell to corporate life just 12 years post-graduation. And no, I didn’t win the lottery—just a lot of smart saving and a dash of stubbornness.

Many of us are taught to celebrate spending—new gadgets, trendy fashion, the latest tech. But just as we schedule time for exercise and mindfulness, scheduling time for savings honors our future self. Think of saving as an act of self-love: by caring for our financial well-being, we ultimately enrich every aspect of our lives.

I was able to do it because my savings gave me the confidence …and it continues even today. A gift that keeps giving

What are my 5 rules for Savings?

1. Emergency Funds: Your Financial Umbrella

Nothing is more important than having cash tucked away for that rainy day when life decides to throw a surprise water balloon fight. Aim for 3–6 months’ worth of expenses. It’s like having an emergency umbrella—only way less soggy.

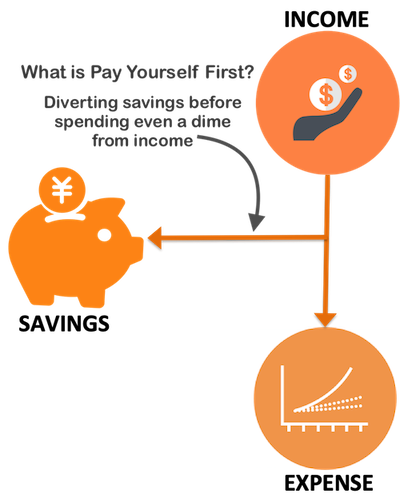

2. Pay Yourself First: Because You’re Basically a VIP

I don’t pay anyone before I pay myself. I set aside a portion of my post-tax income and automate it into an investment vehicle (in my case, Mutual Funds). Think of it like giving yourself a raise every month. Start with 20%, and if that sounds too much (hey, we’re all human), go with at least 10%. Because, hello, you’re worth it!I only spend what is left…NOT spend first and save the balance

3. Automation: The Lazy Person’s Best Friend

Let technology do the heavy lifting. Automate your savings. When your salary drops into your bank account on the 1st, have your savings scooted away by the 2nd. It’s like having a financial butler who shouts, “Save it before you splurge it!” Trust me, if you’re manually moving money around, that shiny new gadget might just lure you away from your savings plan.

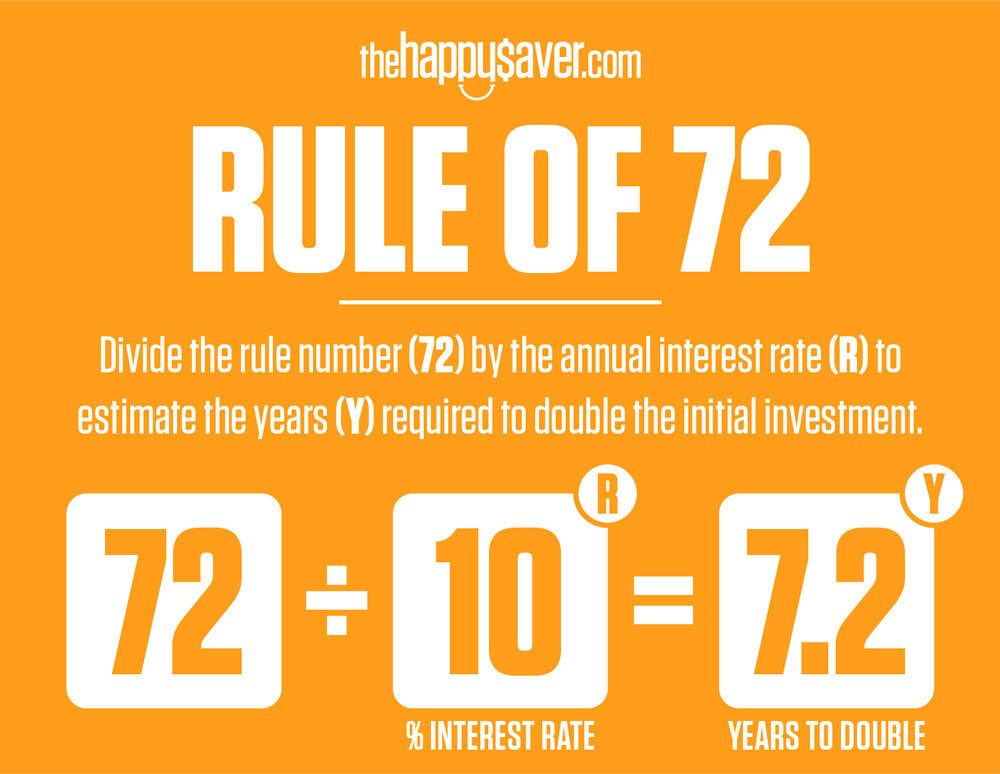

4. The Rule of 72 & Expensive Purchases: Math Can Be Fun!

Ever wonder how long it will take for your money to double? Meet the Rule of 72—it’s like a magic trick for your finances. And when it comes to expensive purchases, my rule is simple: if any expense is more than 1% of your annual income, sleep on it for a week. If you still need it after that week-long detox from impulse buying, go ahead—but maybe treat yourself to a less extravagant treat first.

5. Spend What’s Left: The Magical Equation

Spend only what’s left after you’ve saved. It’s not “save the rest,” it’s “spend the rest.” Otherwise, you might find yourself eyeing that flashy Apple Watch or a ridiculously extravagant vacation that your wallet silently disagrees with.

Savings is NOT a sacrifice; it is an investment in your future happiness and freedom.

Overcoming the Not-So-Fun Challenges of Saving

Saving money isn’t all rainbows and unicorns. Life loves to throw curveballs, and sometimes even the best savings plan can wobble. Here’s how to handle some common pitfalls with a wink and a smile:

Impulse Spending:

We’ve all been there—suddenly convinced that you NEED that glittery gadget. Before you click “buy now,” pause, take a deep breath, and ask yourself: “Do I really need this, or is my inner shopaholic just throwing a tantrum?” Remember you can just sleep on it for a week.Living Paycheck to Paycheck:

If you’re in the thick of it, start small. Even setting aside a few dollars here and there can create a little cushion. Track your expenses like a detective on a hot case, and watch those sneaky leaks in your budget get plugged.Emotional Spending:

When stress hits, retail therapy might seem like the answer—but try a mindful pause instead. Meditate, journal, or take a walk. And if that doesn’t work, maybe have a sarcastic chat with your bank account. It helps.

Remember: Every financial journey is unique. What works for one person may not work for another, and that’s perfectly okay. Embrace your pace and celebrate your progress.

The Ripple Effect: How Savings Can Change Your Life (and Your Mood)

Building a savings habit isn’t just about stacking cash—it’s about cultivating a balanced life where financial security brings out your inner zen master. As your savings grow, you might notice a boost in creativity, better relationships, and a newfound ability to laugh at life’s absurdities. Your financial stress will slowly evaporate, replaced by the joy of knowing you’re prepared for whatever wild adventures or mishaps life throws your way.

Final Thoughts: Celebrate Every Victory!

The key is to enjoy this saving process. I remember when my wife and I first hit a savings milestone. Our savings had barely crossed the 1K mark, and we celebrated by spending a mere $50—because why wait for 100K when 1K deserves a high-five too? We celebrated every little win, turning even the smallest milestones into a mini-party. Trust me, if you don’t celebrate the little victories, the journey can feel as bland as unsalted popcorn.

Embracing savings is like tending to a garden—sometimes you have to pull the weeds (aka impulse buys) and sometimes you have to dance in the rain (or at least save for an umbrella). With patience, a dash of humor, and a sprinkle of automation, you’ll see that every penny saved is a step towards a future that’s as bright as your favorite meme.

So here’s your gentle (and slightly cheeky) reminder: every little bit saved today is a leap towards a brighter, more secure tomorrow. Now go forth, save smartly, and don’t forget to laugh along the way. Happy saving!