The Hilarious Parallels Between Health and Wealth: A Journey Through Kale Smoothies and Compound Interest

This week, I try to bring these two topics together..

Ah, health and wealth—the dynamic duo we all aspire to master. They're like the Batman and Robin of adulting, each requiring dedication, strategy, and the occasional pep talk in the mirror. But did you know they share eerily similar principles?

Let's embark on this amusing journey to uncover how getting fit and getting rich are two sides of the same coin.

1. Thinking Long Term: The "Marathon, Not a Sprint" Cliché

In both health and wealth, overnight success is as mythical as unicorns. You don't chug a kale smoothie and expect abs by evening (oh I know quite a few people who believe that), just as you don't invest in stocks and expect to be the Wolf of Wall Street by morning. It's about consistent effort—like choosing salads over fries or automating monthly savings.

Remember, Rome wasn't built in a day, but they were probably laying bricks daily.

2. Being Realistic: Accepting Your Inner Couch Potato

Setting out to run a 10K when the only running you've done is to the fridge during commercials? Ambitious, but let's dial it back. Similarly, aiming to save half your salary when you're addicted to online shopping might be a stretch. Start small—maybe jog to the door or set up a modest monthly savings plan. Baby steps, folks.

I have seen most clients (in my wealth advisory capacity) grossly underestimate their expenses while overestimating their saving capability!! I also have friends who will talk about burning a 1000 Calories while running and lowball their food calories!!

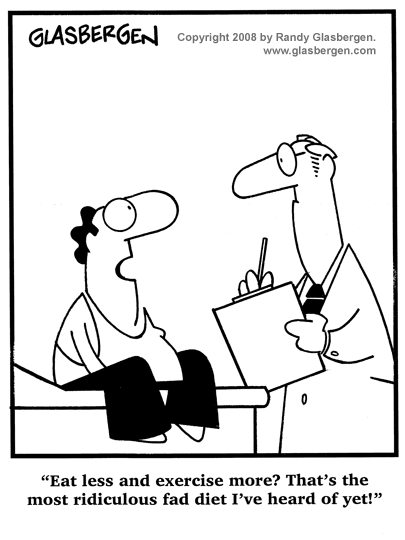

3. Focusing on the Important: The Art of Selective Attention

In the age of information overload, discerning what's essential is crucial. For health, it's not about the latest fad diet but about balanced nutrition and regular exercise. For wealth, it's not about chasing hot stock tips but about consistent saving and prudent investing.

Time in the market Vs Timing the market

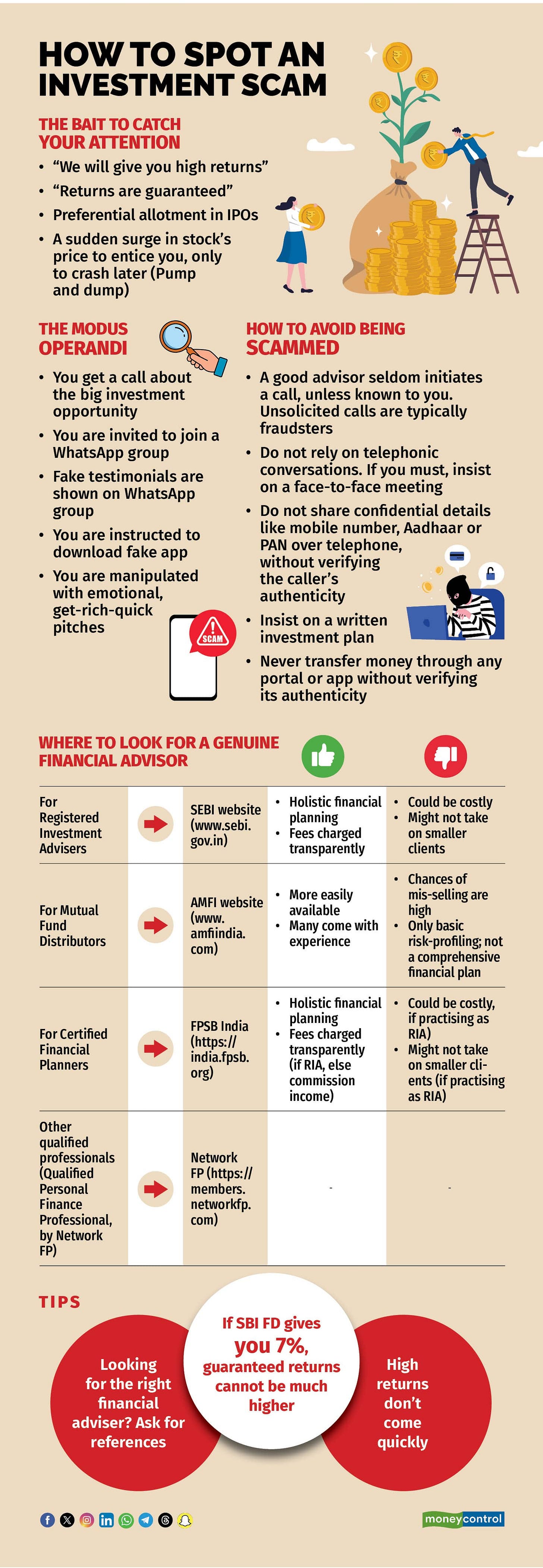

From miracle weight loss pills to get-rich-quick schemes, the world is full of distractions. Developing a discerning eye to filter out the noise and focus on proven methods is essential.

Keep your investments/workouts boring and your life Interesting.

When your investments/diets become interesting, then your life becomes volatile!

4. Find a Conscience keeper: Yes, that nagging partner or friend or even that gym trainer

I tried various methods to get fit…tried running, swimming, strength training, HIIT…yes, almost everything but then I would give up. Yes, i know you are like that too.

And then, I saw how some of my friends were consistent with their cycling - yes, cycling in chennai roads in the heat (yes they cycle at 5AM but it is hot) or how i was consistent with my golf. The difference was a group of friends!!!

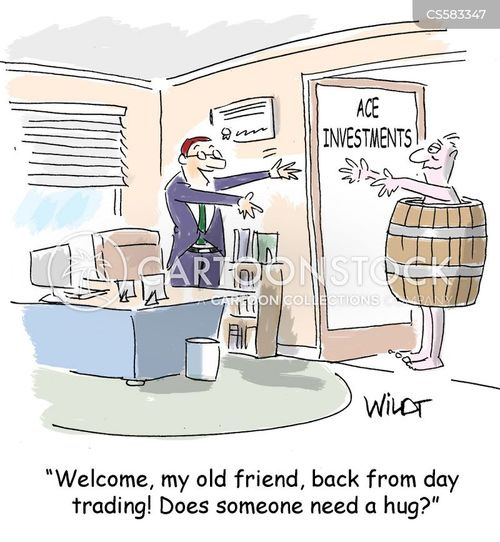

5. Short-Term Fixes Don't Last: The Fad Diets and Day Trading Debacles

Crash diets might help you shed pounds faster than a cat sheds fur, but they'll likely return with interest. Similarly, day trading based on hot tips can lead to quick gains followed by quicker losses. Sustainable habits, like balanced eating and long-term investing, are the tortoises that win the race.

Every week I see people following a new diet while skipping the boring part. Similarly in investing, everyone is focused on that one stock that will turn their life…Or even worse fall for a scam!!

6. Accepting Uncertainty: Embracing the Chaos

Life is unpredictable. Today you're jogging in the park; tomorrow you're nursing a sprained ankle from tripping over a squirrel. Markets fluctuate, and so does your weight after a holiday feast. Embracing uncertainty and adapting is key.

7. Not Following Anyone's Advice Blindly: Your Aunt's Cabbage Soup Diet Isn't Gospel

Just because your neighbor's cousin's friend made a fortune investing in alpaca farms doesn't mean you should. Similarly, not every diet trending on social media is your golden ticket to health. Do your research, consult professionals, and tailor strategies to your unique situation.

Everyone has an agenda…look beyond the message, research and ONLY then follow!

8. Read, Read, Read: Knowledge Is Power (and Sometimes Amusing)

Educate yourself. Dive into books, articles, and reputable blogs. The more you know, the better decisions you'll make. And who knows, you might stumble upon humorous takes on serious topics that make the journey enjoyable.

I am inspired by these people and hope this short list helps you:

Morgan Housel - I love his books (gifted to many of my friends), podcasts and tweets. Morgan makes investing simple.

Peter Attia - I loved his book - Outlive and also enjoy his podcast (no not paying for it as yet).

Ritesh Bawri - A friend and wellness influencer. I have also gifted his book to many.

Krish Ashok - A co-parent (The School KFI) and a person who makes the science of food so accessible. Again his book has been one of my favourite gifts.

Fittr - I have been part of this online group for years and everyday someone inspires me.

In conclusion, nurturing your health and wealth requires patience, realistic goals, focus, discernment, adaptability, critical thinking, and continuous learning. Approach both with a sense of humor, and you'll find the journey not only rewarding but also entertaining.